1920 to 2020

Bloomberg published an article about a recent study that suggests that the 1918-1920 influenza pandemic largely contributed to shaping the Nazi mentality in the young generations in Germany.

The study was done by the New York Federal Reserve. The authors admit there is no place for direct conclusions, but the correlation seems to be there: cities with most influenza deaths in 1918 which saw little social expenditure form the governments witnessed an increase in their proportion of votes for the Nazi party leaders in Germany.

The study suggests that the main reason for that social change was the disappointment of the people with the actions of their governments, which failed to help them through the pandemic fallout. Feeling resentful to their leaders, they started looking for alternative directions in social policies – which were readily offered by the right-wing politicians.

Risk-mapping

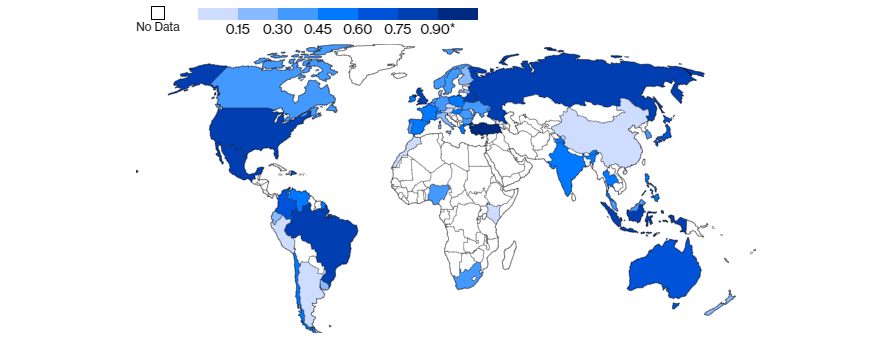

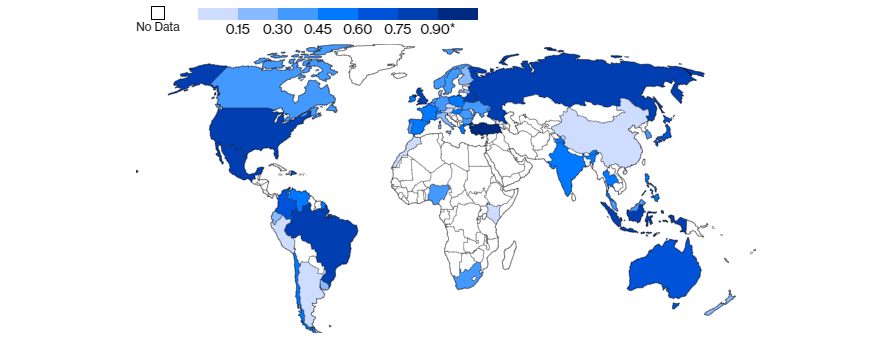

Basically, those who felt most left out shifted into the right spectrum of political direction. Now, the map below shows the level of happiness among people with the actions of their respective governments.

Source: Bloomberg

This map is based on public polls. Obviously, we have to keep in mind that not all countries grant the liberty to their citizens to express their dissatisfaction with the actions of their governments. So a certain political common sense needs to filter the colors coming from this picture. But still, what we see is that, generally, Americans, Brazilians, Russians, and Turks are utterly unhappy with what their governments did in response to the coronavirus and economic damage caused by it. Therefore, these countries, if we were to continue the logic suggested by the study, may be a ground for a social shift towards the right socio-political spectrum. “What does it mean for the currencies though?” one may ask. It will mean instability.

Outcomes for the USD

Specifically for the USD, it will mean instability. Although it is the primary global reserve currency, its positions may be undermined by any shift from a center-balanced political-economic direction of the government. Donald Trump’s views and general direction do not appear exactly center-balanced. Rather, they are protectionist-expansionist. In the strategic horizon, that may be the most dangerous direction for economic development in the US. Numerous fundamental factors, such as the labor market, the government debt, external policies, and many others create an unprecedentedly tensed economic background for the US economic system, which, in general, risks getting overheated. In the meantime, the US President’s actions, internally or externally oriented, do not appear to be exactly cautious. Overall, that creates a potentially dangerous world for the US dollar to exist.

That means, strategically, the undisputed global dominance of the USD may come to end pretty unexpectedly.

That is no bad news for a trader though – as long as you get prepared for such a scenario as well. Let’s stay put and watch the dynamics.