Disclaimer:

This material does not constitute a call to trade, trading advice, or recommendation and is intended for informational purposes only.

What is Bitcoin halving?

There are over 19.8 million Bitcoins already, and the top number they will reach is 21 million. That number isn’t supposed to be arrived at until one hundred and fifteen years from the time of this writing, in 2140. At that point, miners will have to rely only on transaction fees to keep their networks secure.

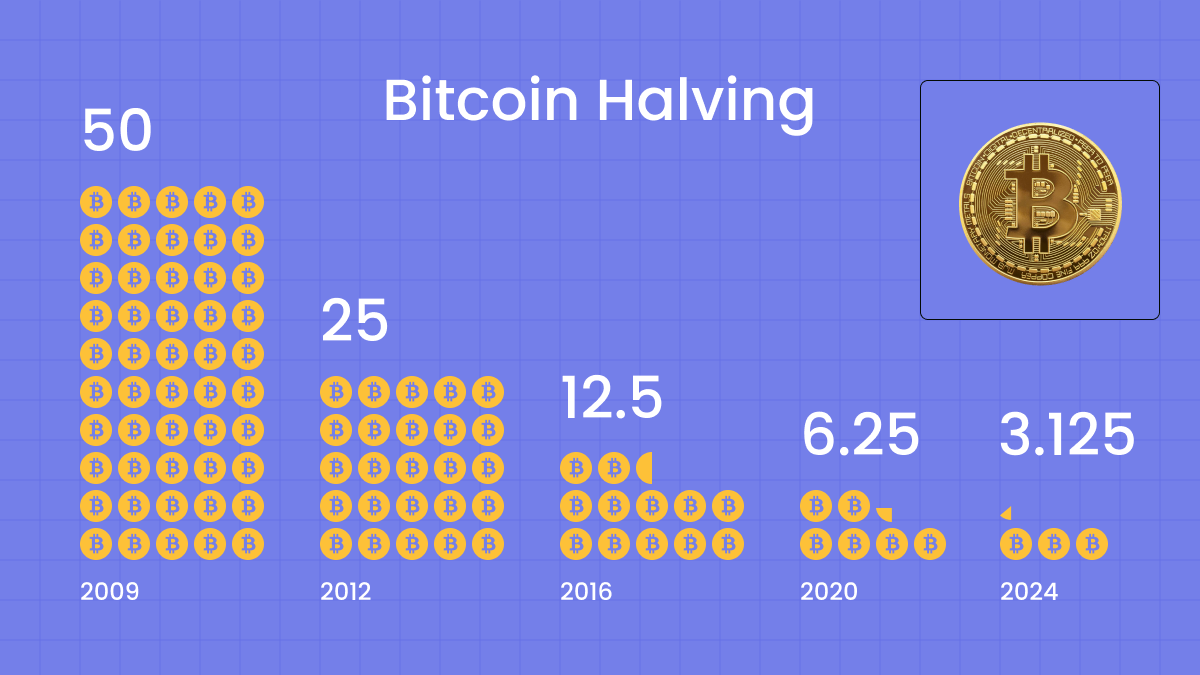

To slow that process down and make sure it lasts, every time 210 000 BTC blocks are introduced, which is about every four years, the number of all Bitcoins is halved. The mining reward is cut by 50%.

Why does Bitcoin get halved?

Halving is part of Bitcoin’s innovative supply mechanism. It is built into BTC’s protocol to make it so that BTC supply mimics that of precious metals. That means keeping it scarce. Bitcoin halving:

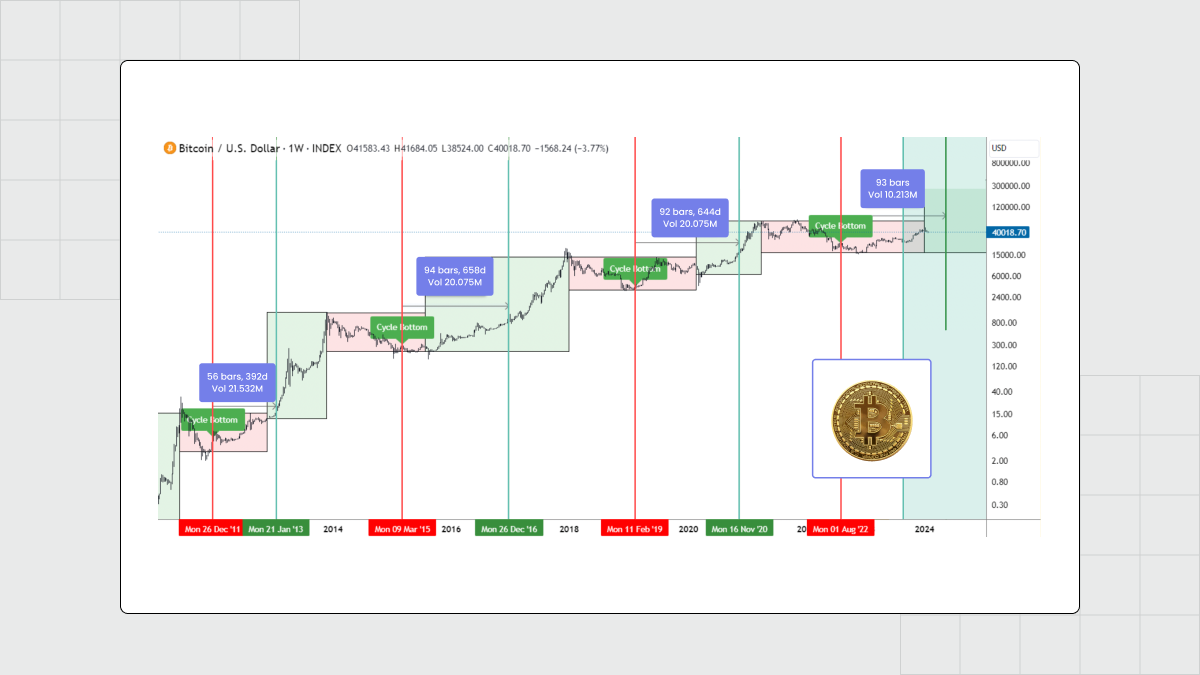

Builds value over time as the price stabilizes well above the halving point a year or so after each event.

Limits supply to make it scarcer over time.

Counteracts inflation to preserve Bitcoin’s value against fiat inflation.

Encourages network security by driving miners into the arms of transaction fees.

Drives up price by increasing demand on anticipated reduction of supply.

- Builds value over time as the price stabilizes well above the halving point a year or so after each event.

How the BTC price changes over time after halving

What happened at the last Bitcoin halving?

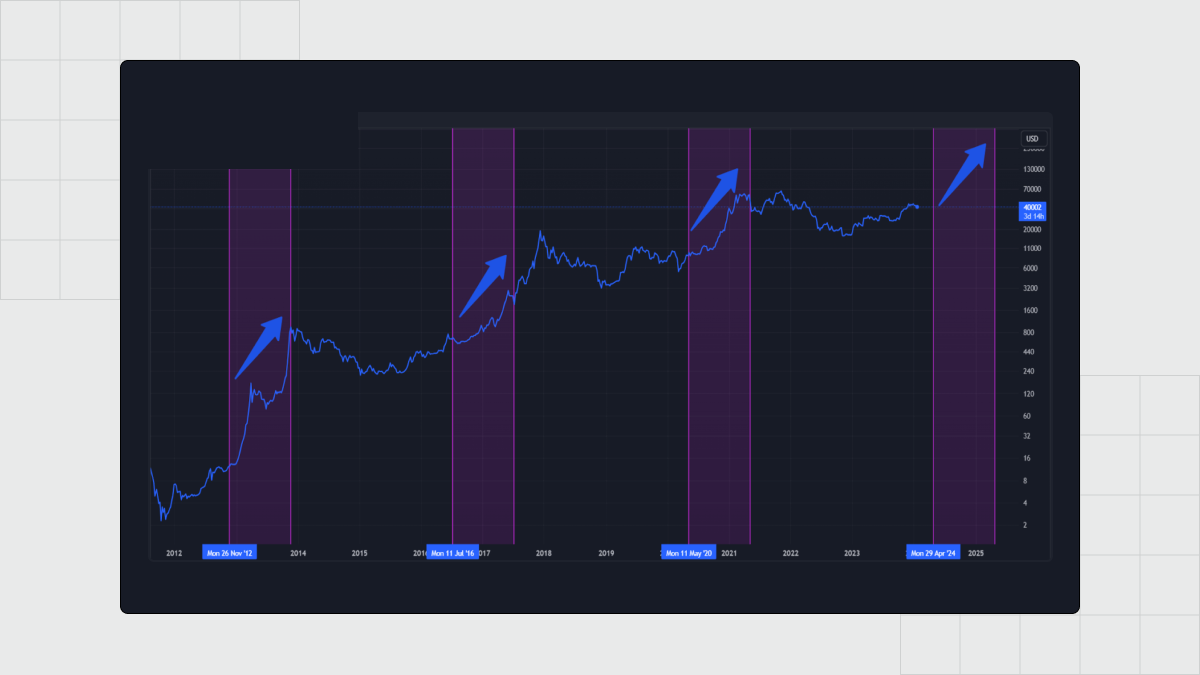

| Bitcoin halving event | Price on Halving Day | Price 365 days later |

| 2012 | $12.35 | $959.59 |

| 2016 | $650.53 | $2952.67 |

| 2020 | $8821.42 | $60 762.21 |

| 2024 | $63 762.87 | $83 671.48 |

The BTC price during the halving and 365 days later

The most BTC halving took place on April 19, 2024. The mining value of a block went from 6.25 to 3.125. The value of the cryptocurrency experienced a relatively modest rise in the days leading up to the event, if compared to the boosts it had received right before the previous halvings. It has, however, grown by 31% in the year since.

Before that, the last halving of BTC’s mining reward (from 12.5 to 6.25 per block) was on May 11, 2020, just as COVID-19 had the world in its clutches. Bitcoin grew by the same 31%, from $6877.62, to $8821, in the month prior.

Trading on the Bitcoin halving

Traders can medium to long-term strategies to profit from BTC halving. The price surge happens every time between six and twelve months after the event.

Effective trading strategies for Bitcoin halving include:

Long-term Holding (HODLing). If you hold on to your Bitcoins as the halving takes place, and just keep holding on to them, you’ll have more value at the end than what you started with.

Using technical analysis. By evaluating the indicators and patterns available with brokers like FBS to figure out when the halving-related volatility will be cooking, you can buy and sell at the right times.

Portfolio diversification. Always a good idea. You never really know for sure what’s going to happen on the market. Spread out your investments to keep at least some of your money safe.

Informed trading. Investor sentiment, regulatory updates, economic developments of every stripe - these are all potential dangers to the market value of BTC. Get with the program, and stay on top of market trends and global economic indicators.

FAQ

Is halving good for crypto?

The halving of BTC is generally seen as a positive event for the cryptocurrency, as it reduces the rate at which new Bitcoins are created, leading to increased scarcity. This scarcity can potentially increase demand, which in turn can increase the value of Bitcoin. Other positive factors of BTC halving include: predictability, long-term sustainability, increased market attention, pushing the industry towards a healthier and more sustainable mining ecosystem.

When is the next halving?

The next BTC halving event will take place in the Spring of 2028. Be ready with FBS.