July 09, 2025

Psychology

What Is Trader Burnout and How Can You Prevent It?

Trading requires extreme focus, resilience, and mental clarity. The pressure can take its toll. If you are feeling stressed and exhausted all the time, you may be facing trader burnout. Here are some tips on identifying and overcoming it.

Reg flags of trader burnout

Trading is rewarding and exhilarating, but it’s also extremely demanding. Intense focus, dealing with risks, and information overload can sometimes feel like too much, and all this pressure can build up and lead to trader burnout – a state of physical, emotional, and mental exhaustion that drains motivation and clouds the judgment of a trader. Burnout is more common than many traders care to admit.

Recognizing burnout is the first step. Burnout manifests on different levels: emotional, physical and behavioral. The problem is, it doesn’t happen overnight; it often goes unnoticed until the trader’s performance suffers. It just sneaks up on them. Don’t miss these signs.

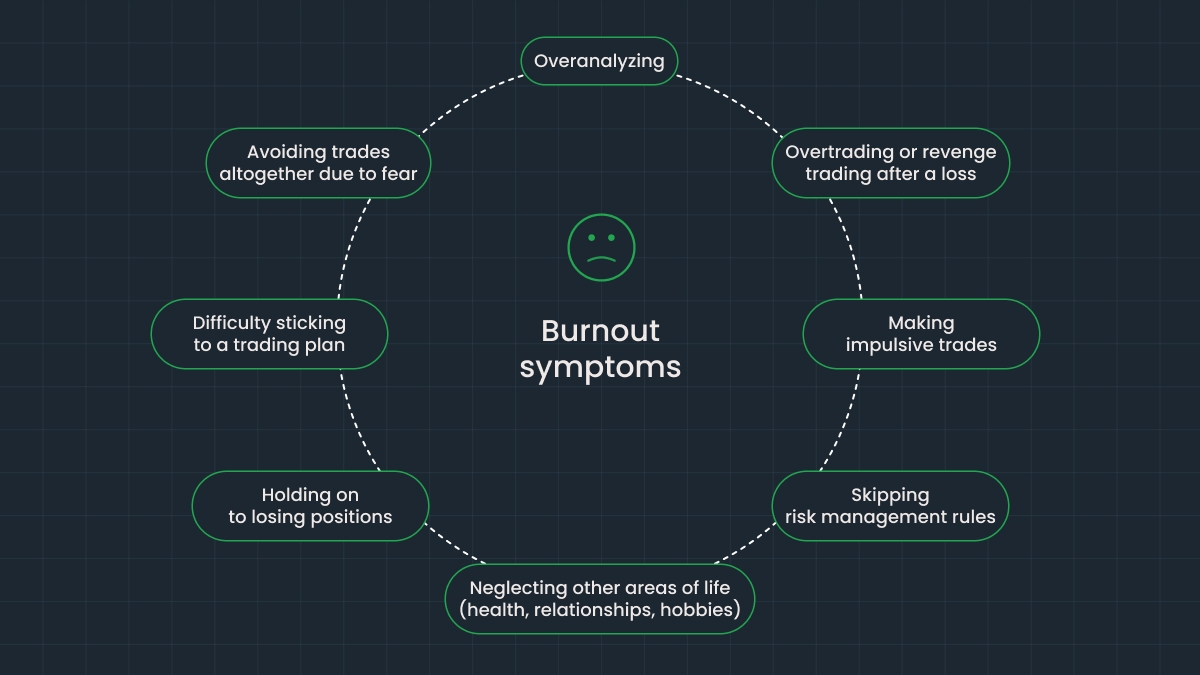

Changes in performance may include:

Overtrading or revenge trading after a loss. Even if you feel that you can restore your capital after a big loss or a series of losses by buying and selling whatever seems profitable, it’s a mistaken strategy that will only lead to even bigger losses. Emotional response is natural, but you don’t have to act on it. Take a breather and set firm trading rules based on technical and fundamental analysis.

Avoiding trades altogether due to fear. The opposite extreme from overtrading takes the form of some investors putting off entering trades entirely when their anxiety takes hold. To cope, start with smaller sums and increase them gradually until you feel more confident. Don’t forget to rely on analysis!

Skipping risk management rules — a dangerous mistake. Manage risks on every single trade you enter, even the smallest. That way, the possibility of a large trade going south will be much less likely.

Holding on to losing positions. When the horse dies, it’s time to get off. Create a trading plan and use stop-loss orders to prevent falling into “hope mode”, which will only hurt your performance.

Making impulsive trades. Patience and discipline are two keys to good trading, and when you lose them, huge losses are only a matter of time. FOMO (fear of missing out) won’t do you any good: make a clear trading checklist (entry criteria, risk/reward, market conditions) and stick to it. If possible, limit your daily number of trades and be more selective.

Overanalyzing. Rethinking past trades and second-guessing decisions wastes your energy and makes you less confident. Backtest your strategy, use a demo account before entering a real trade, and track results: real data helps reduce doubt.

Difficulty sticking to a trading plan. Sometimes exhaustion makes you wander off your plan. When that happens, you can simplify and visualise it (create a chart of a mind map). Journaling also helps — keep track of your trades.

Neglecting other areas of life (health, relationships, hobbies). This is an obvious sign, but a very serious one. The more you ignore your life outside of trading, the worse your performance becomes. Set non-trading hours (even the Forex market isn’t open 24/7!), adopt healthier habits (regular meals, good sleep, physical activity), spend quality time with family and friends, do something that brings you joy.

FBS makes trading easier. Join us if you want to grow and succeed securely!

Possible emotional signs of trader burnout:

Irritability or frustration with small losses or missed trades. Being disappointed over a lost trade is okay, but if it triggers a disproportionate emotional response, it might be a sign of a burnout. This sensitivity reflects a worn-out emotional system struggling to cope with too much pressure.

Increased anxiety before, during, or after trading. Persistent anxiety that doesn’t go away is not caused by actual market risk, but signals of mental exhaustion. When even small decisions seem difficult, it’s time to take a break.

Loss of motivation. You aren’t as interested in the markets as you used to be, and everything feels like a chore now. This isn’t laziness, it’s a sign you need rest and recovery.

Feeling overwhelmed or mentally drained. Mental exhaustion makes errors more likely and decision-making slower.

Mood swings tied to trading outcomes. Ups and downs are a part of trading, but if your mood completely depends on your results, it’s a warning sign.

How to fight trader burnout effectively

If you recognize even some of these signs, it’s time to take care of yourself. Dealing with burnout and chronic exhaustion may take a while, but once you beat it, you will be a better trader and a happier person.

The following tips also work if you want to be a step ahead and avoid burnout: prevention is better than cure.

Step away from the screens once in a while. Taking a break really helps: even a few days off can refresh your perspective. Don’t let FOMO (fear of missing out) overpower you — the markets will still be there when you return. Also, set time to recharge during the day: take a quick walk, read a book, meditate, etc.

Go over your strategy again. Make your trading plan simpler, set rules and let go of unrealistic expectations. Focus on quality, not quantity.

Sleep and take care of your health. Make sleep, proper meals, and regular physical activity your priority.

Use a trading journal to reflect on your trading journey. It builds self-awareness and helps prevent making the same mistakes again.

Talk to the community. Share your experiences with a trading buddy or a mentor. It may help you identify or prevent mistakes.

Don’t hesitate to ask for help. Connect with a family member, a friend, a therapist — anyone you trust and feel comfortable talking with. Asking for help is a sign of strength, not weakness.

Bottom line

Protect your mental and physical health just like you protect your financial wellness. Burnout is not a failure, it’s a sign. Use it as an opportunity to pause, reset and take care of yourself.