Among chart patterns that traders rely on, the Cup and Handle pattern stands out for its clarity and reliability in bullish continuation setups.

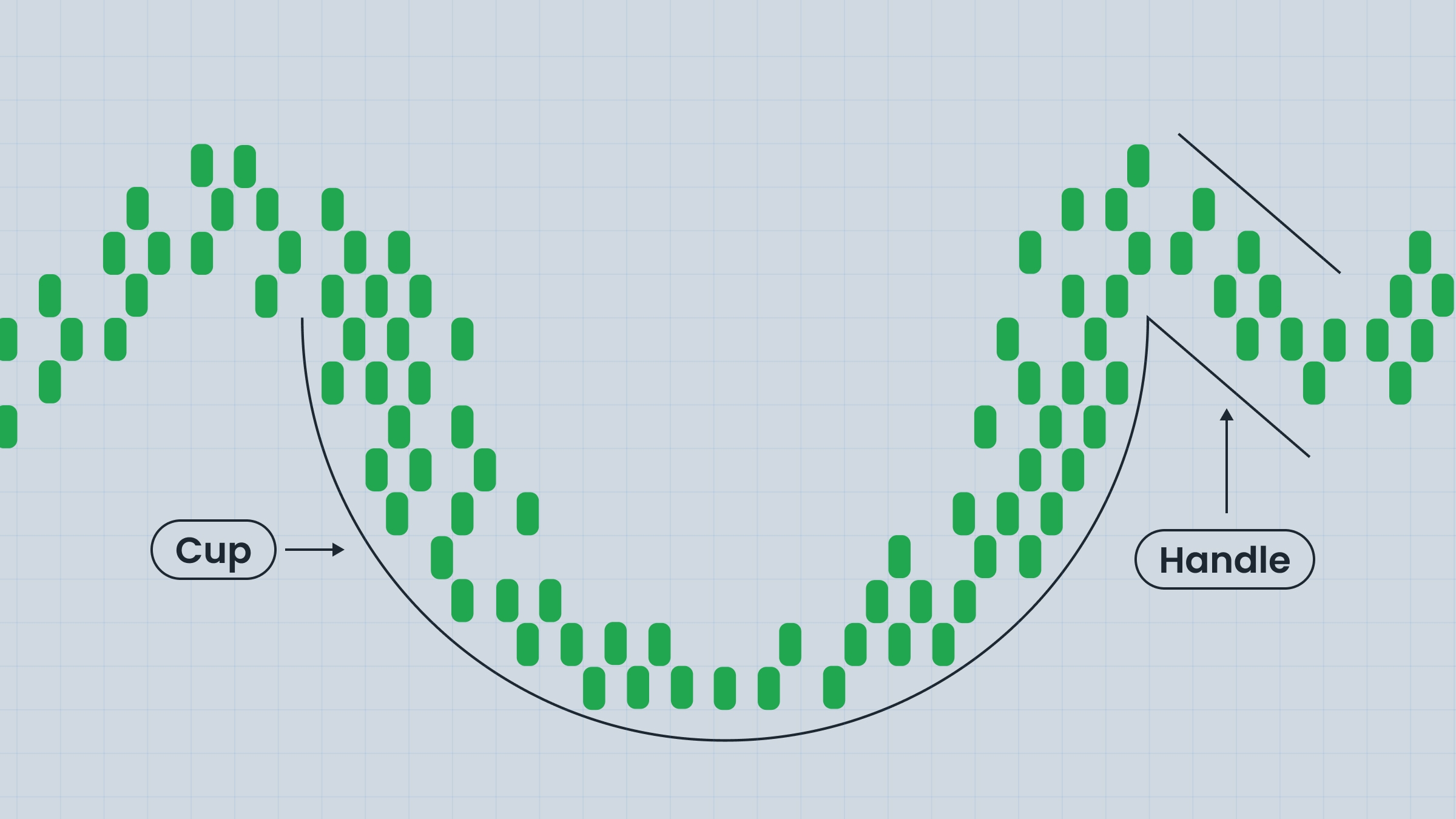

It gets its name from its shape: a rounded “cup” followed by a smaller dip or sideways movement — the “handle.” When spotted early, this formation can offer a low-risk, high-reward entry point in an ongoing uptrend.

What is the Cup and Handle pattern?

The Cup and Handle pattern is something you’ll often spot after a decent run-up in price. At some point, the momentum slows down, and the chart starts curving into this smooth, rounded dip called a cup. It’s basically a phase where the market cools off, and things between buyers and sellers settle.

Then comes the handle, which is usually a small pullback, or just some sideways action. You’ll often see it sloping down a little. Once the price breaks out above that zone, especially if there’s strong volume, many traders take that as a sign the uptrend might pick up again.

How to spot a Cup and Handle pattern

Traders appreciate this pattern for how relatively easy it is to identify. To recognize it, look for a rounded U-shaped bottom rather than a sharp V. The cup should show a fairly symmetrical decline and recovery in price. After the cup forms, the handle appears — this is usually shorter in duration and shallower than the cup.

Volume also plays a role. It often decreases during the cup’s formation, suggesting reduced market activity. Then, when the breakout occurs, volume typically increases significantly, confirming the move.

Trading the Cup and Handle

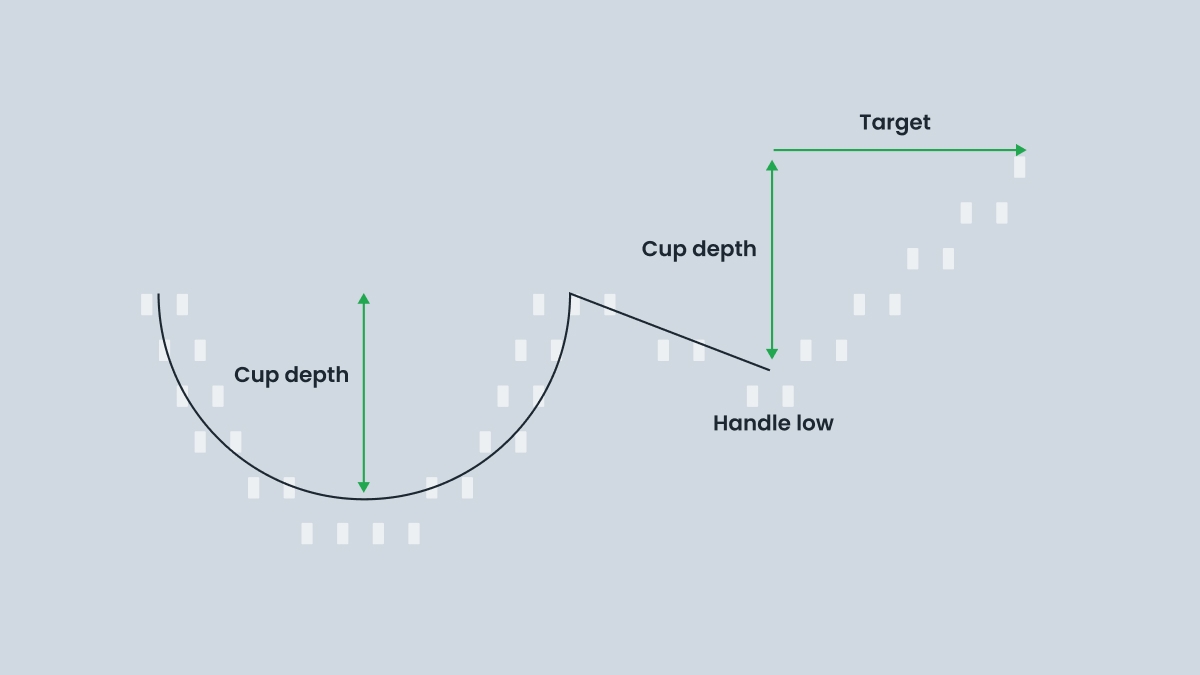

Most traders prefer to enter a long position when the price breaks above the handle’s resistance, especially if this breakout is supported by rising volume. To manage risks, you can set a stop-loss just below the lowest point of the handle.

As for profit targets, a simple method is to measure the depth of the cup from the peak to the bottom, and project that distance upward from the breakout level.

It’s also smart to use other technical indicators to confirm the breakout and choose a position size that fits your risk tolerance.

Inverted and Reverse Cup and Handle patterns

Not every cup and handle setup points to a move higher. There are two bearish versions traders keep an eye on: the Inverted Cup and Handle and the Reverse Cup and Handle. The inverted one looks like an upside-down cup, with the market gradually rolling over, then bouncing a bit to form the “handle.” If the price drops below that level, it often signals more downside ahead.

The reverse version is a bit different. It usually forms after a long rally and suggests buyers are losing strength. The price curves lower, stalls briefly, and may then continue to drop. Both patterns can act as early alerts and are useful for spotting short trades or knowing when it’s time to step back from a bullish position.

Summary

The Cup and Handle pattern isn’t some rare formation. You’ll see it pop up across charts, whether you’re into stocks, Forex, or even crypto. It’s not hard to recognize once you’ve trained your eye for it: a rounded dip, a short pause, then a breakout (ideally). The pattern gives structure to what might otherwise feel like random price movement.

That said, it doesn’t always work out cleanly. Volume doesn’t always cooperate, breakouts fail, and sometimes the whole setup just fizzles. But when things line up, the pattern can offer a decent framework for spotting momentum. And knowing its bearish counterparts can help you stay alert when markets start shifting the other way.

FAQ

What is the Cup and Handle pattern in trading?

It’s a bullish continuation pattern that looks like a rounded cup followed by a small dip or sideways handle. The Cup and Handle pattern signals that a market may resume its upward move after a period of consolidation.

How do you trade the Cup and Handle pattern?

Most traders enter after the price breaks above the handle’s resistance. A stop-loss is typically placed just below the lowest point of the handle. The profit target can be estimated by measuring the depth of the cup and projecting it upward.

What are the main Cup and Handle pattern rules?

Look for a smooth, rounded cup, not a sharp V-shape. The handle should be shorter and form after the cup. Watch for volume to drop during the cup and rise sharply on the breakout. These basic cup and handle pattern rules help filter out weak setups.

What is the Inverted Cup and Handle pattern?

The Inverted Cup and Handle pattern is a bearish reversal pattern. It has a form of an upside-down cup followed by a short movement (the handle), which often leads to a downward breakout. Traders use it to predict short-selling opportunities or exits from long positions.