Pending Order

Quite often, there are situations when it is better to buy or sell an asset at a price other than the current one. For example, the price of an asset is very close to a support level, but it’s too early to open a trade. Or a trader is waiting for the price to break through a resistance level to reach the next target.

In addition, sometimes, the market is highly volatile, and trading at current (market) prices may not be the most profitable.

Pending orders are used to execute a transaction at a fixed price, rather than the current price of the asset.

What is a pending order?

A pending order is an order to the broker to open a trade when certain conditions are reached, for example, when the price of an asset approaches a particular value.

How does a pending order work?

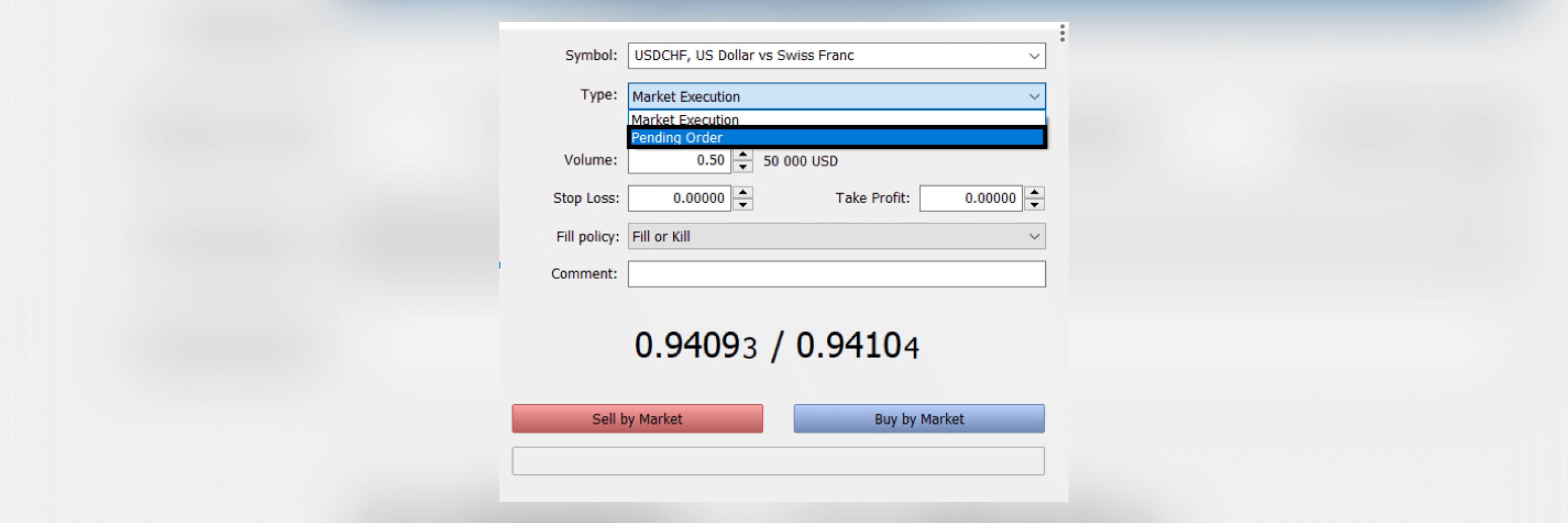

To form a pending order, press New Order and choose the asset. Instead of selecting market execution, select Pending Order.

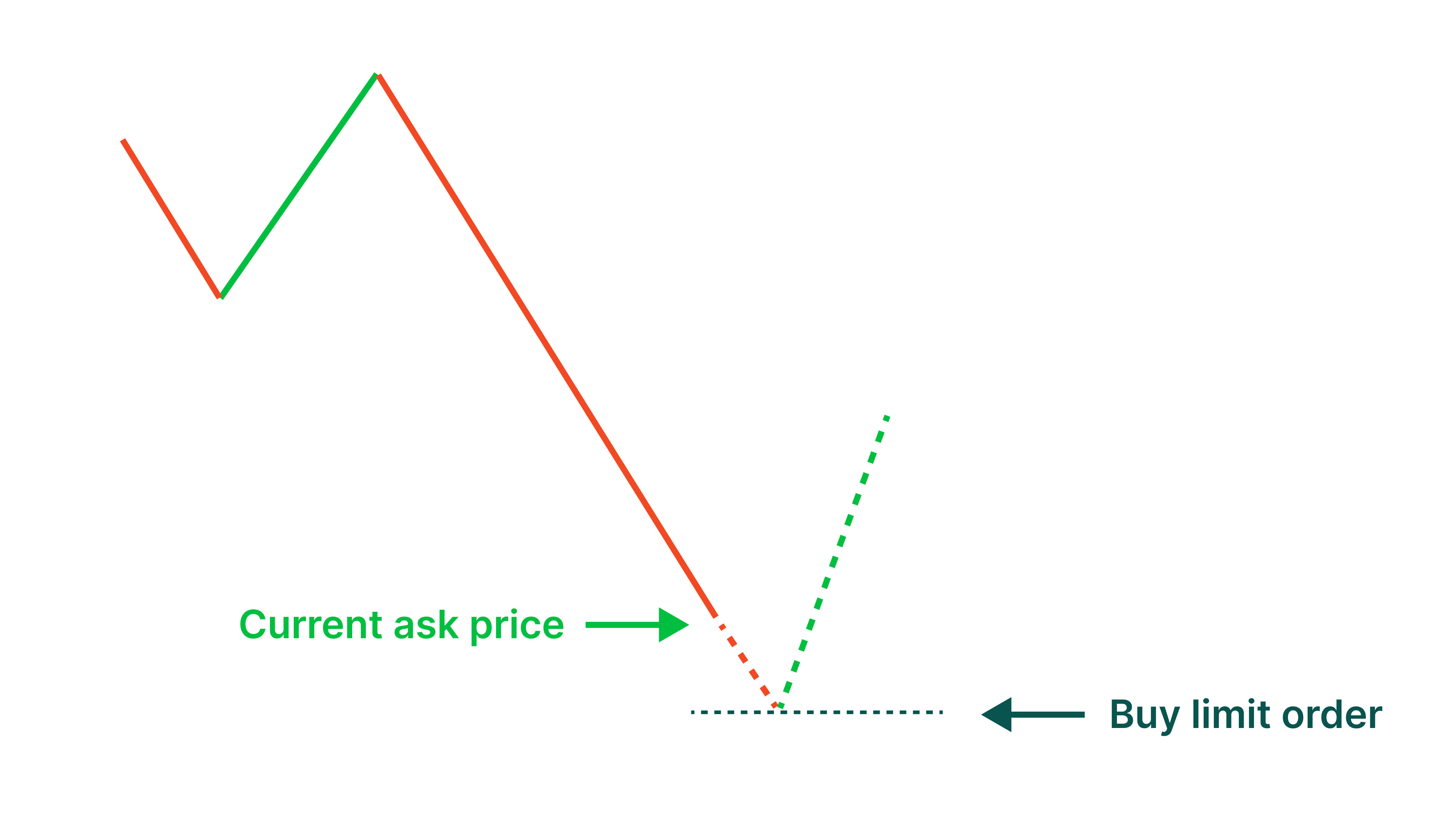

After that, it is necessary to choose the type of pending order. For example, the type Buy Limit means the pending order will be executed when the price reaches a specific value lower than the Ask price.

After the Ask price reaches this value, the order will be executed at this price.

Types of pending orders in MetaTrader

There are three types of pending orders in MT4 and MT5:

Buy Limit/Sell Limit

Buy Stop/Sell Stop

Buy Stop Limit/Sell Stop Limit

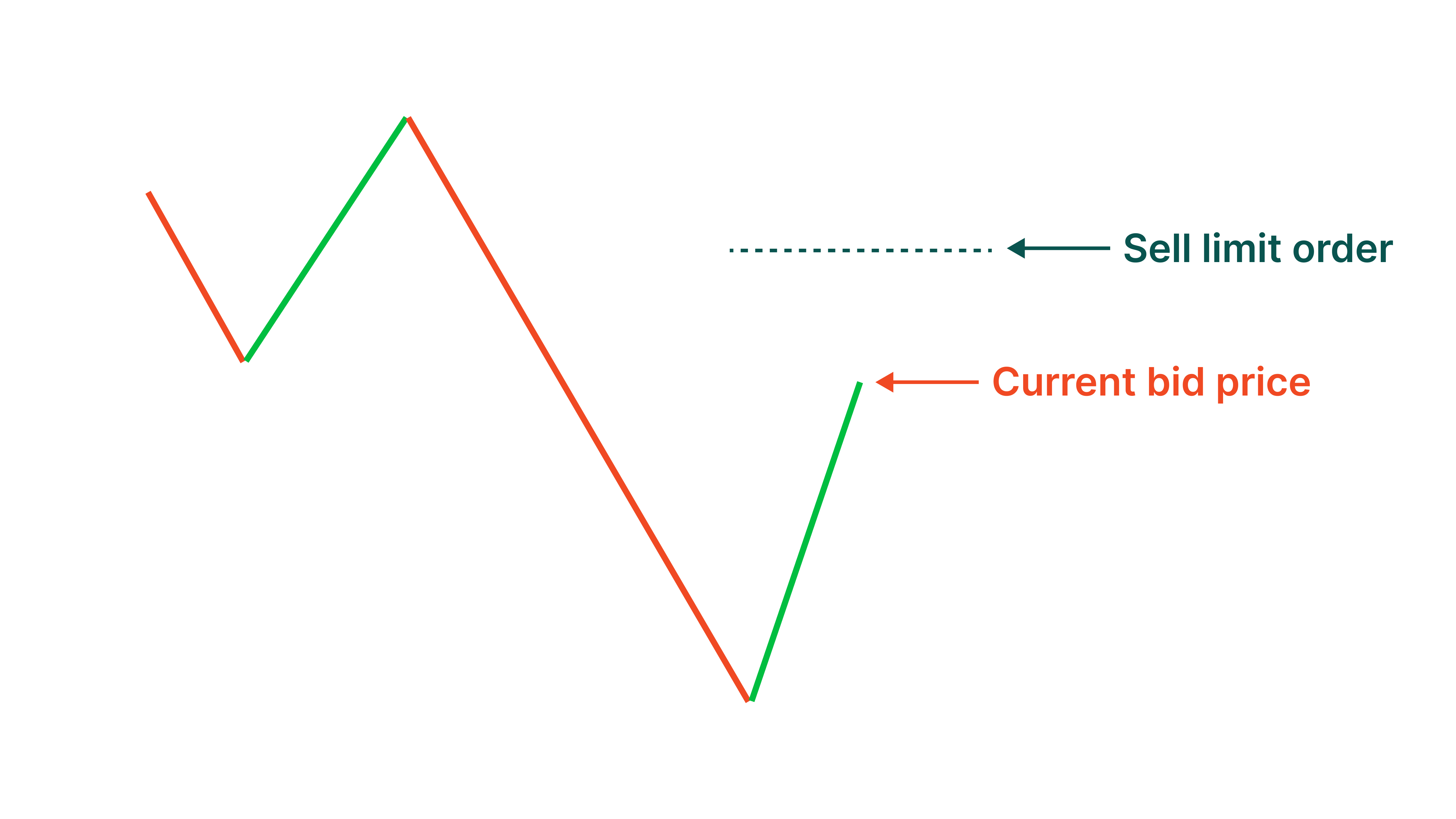

The simplest pending orders are the buy limit/sell limit. They are used when a trader just wants to buy an asset lower than the ask price or sell the asset higher than the bid price. When setting an order, the trader must specify the buy or sell price at which he wants to open a deal.

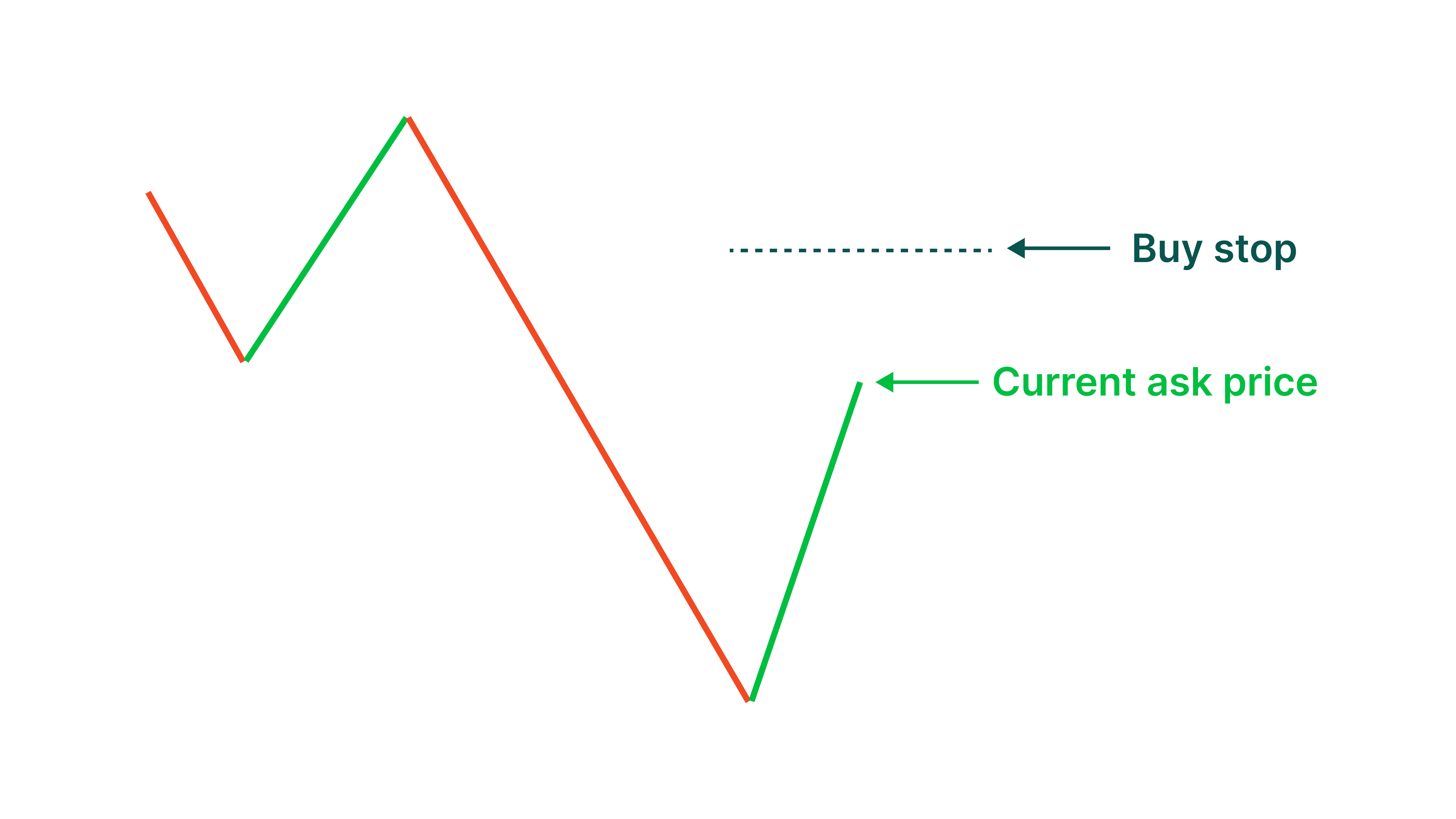

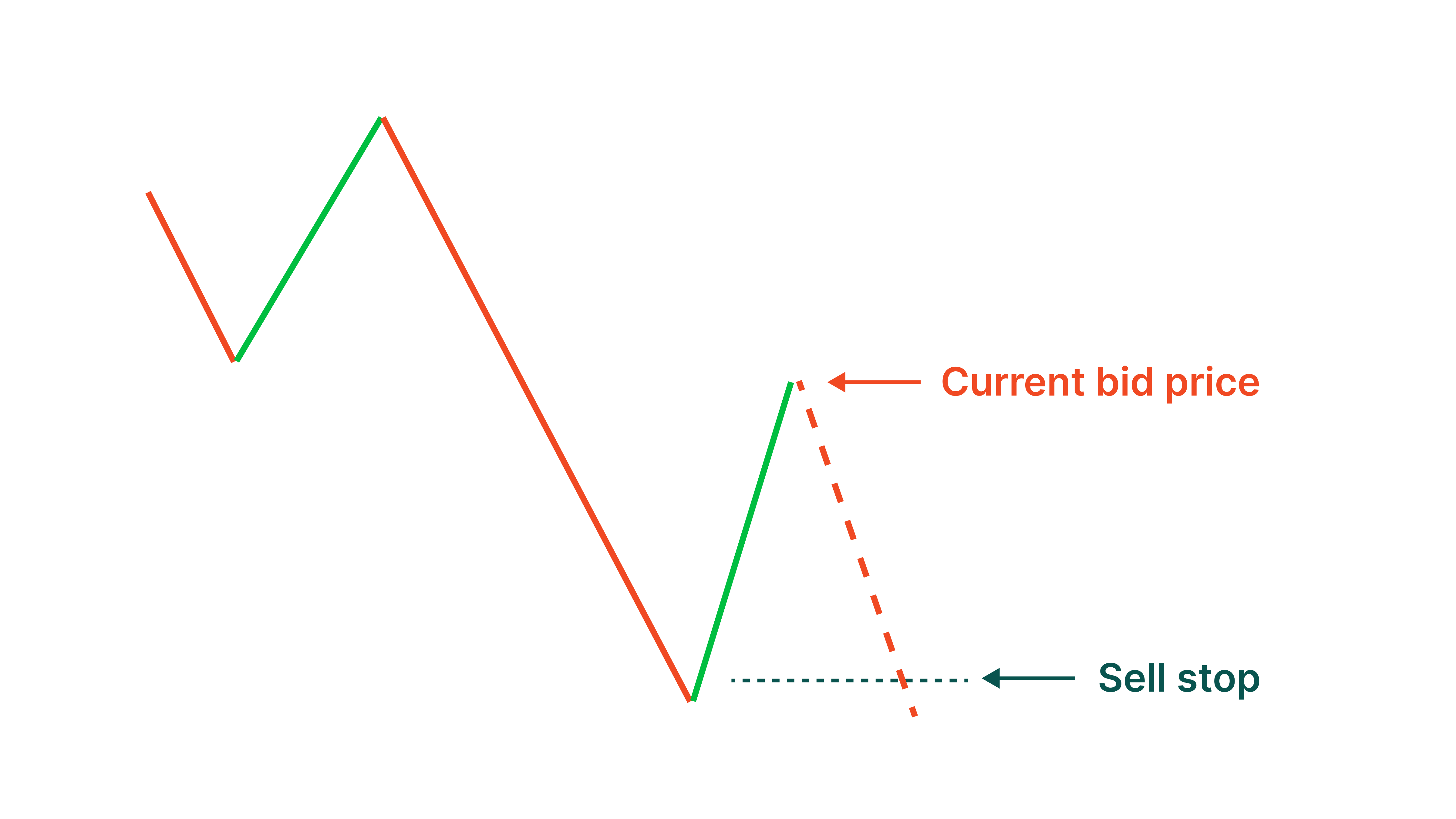

Buy Stop and Sell Stop orders are a bit more complicated. They are used to buy an asset at a price higher than the ask price or sell at a price lower than the bid price. These orders are used if, for example, the trader is waiting for the breakdown of any significant support or resistance level.

Let us consider, for example, the pair USDJPY. Let us assume that the current quote is 135.80. There is resistance at 136, upon breakthrough of which the price may continue to rise. The trader sets the Buy Stop Pending Order at 136.00. The order will be executed as soon as the resistance level is broken through and the price reaches this value.

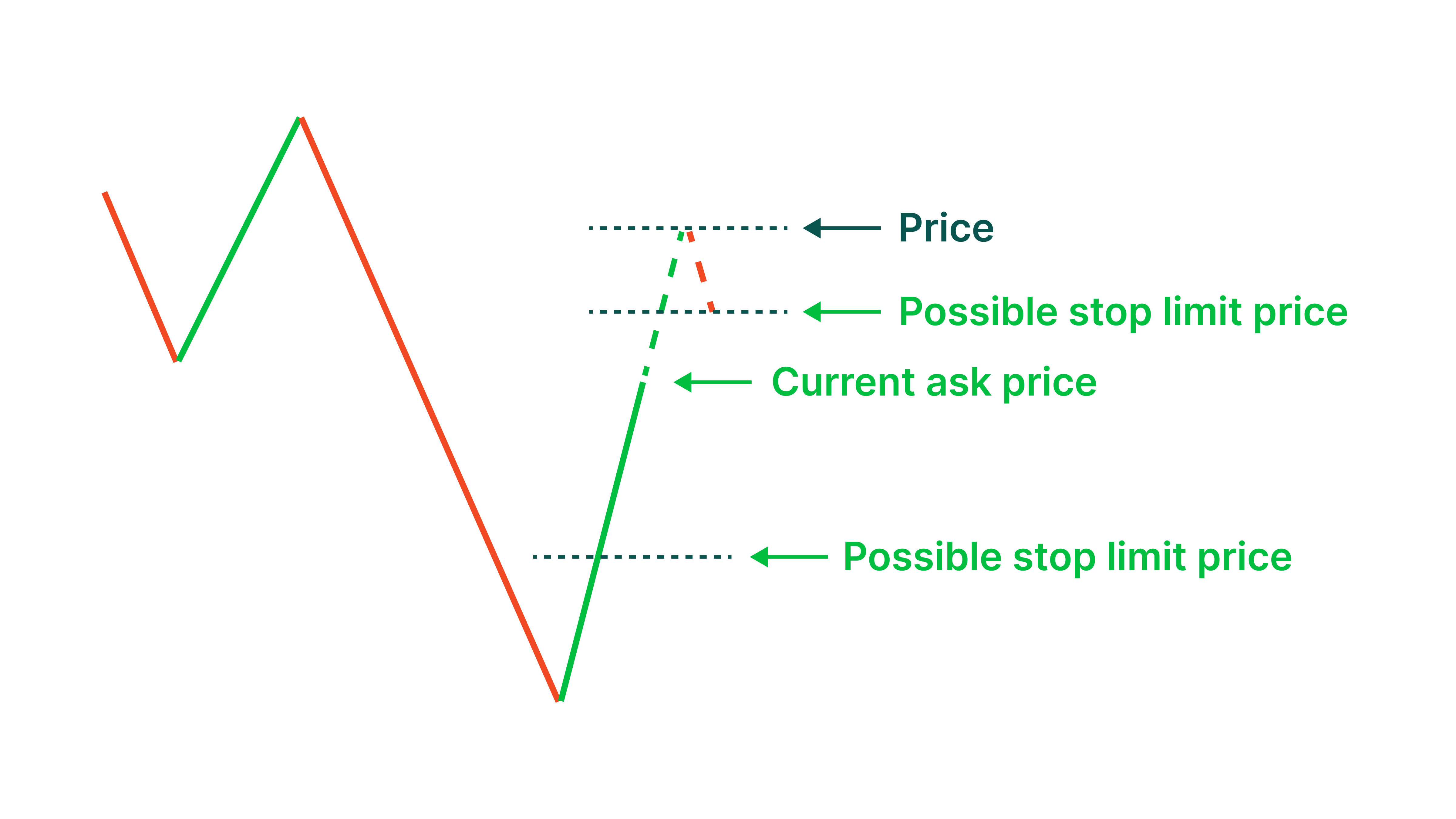

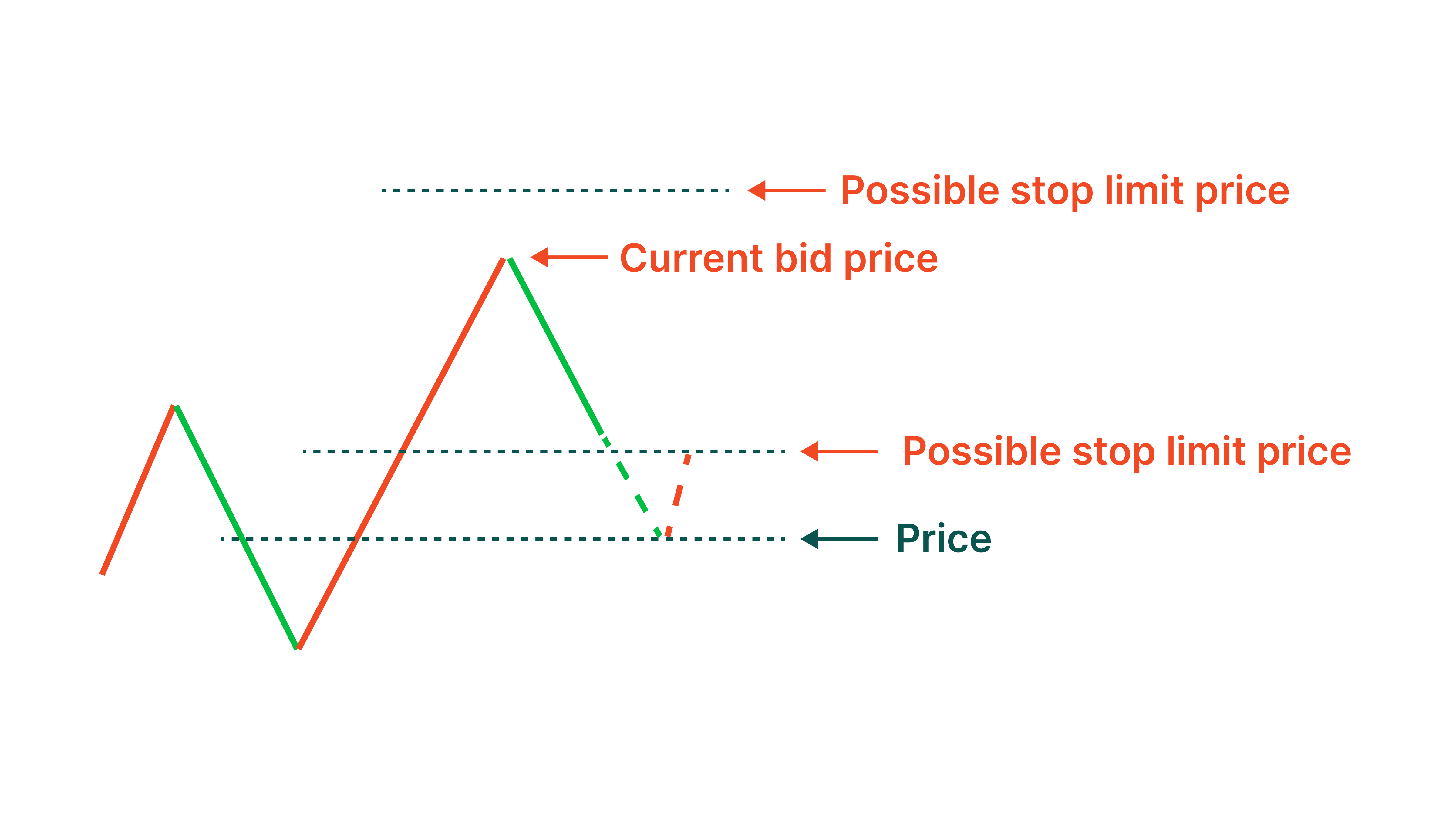

Buy Stop Limit/Sell Stop Limit pending orders combine the previous two order types. Suppose the trader is again waiting for the resistance level to be broken and the price to continue rising. However, it sometimes happens that the price only pierces the level, then returns lower (a pullback from the level), and only after that a breakout follows. The trader can use a Buy Stop Limit pending order to buy the asset on a pullback and a Sell Stop Limit pending order to sell the asset on a pullback.

In our example, the current price of USDJPY is 135.80. The resistance level is at 136. The trader believes that if the price breaks through the resistance, a buy is possible, but he will only buy if the price first bounces to 135.75. In this case, the Buy Stop Limit specifies the Price, upon achievement of which the order will be activated and will turn into a Buy Limit order. The order Buy Limit will be executed at a price specified in Stop Limit Price.

Here are the general rules for choosing pending orders:

Type of order | Condition |

Buy Limit | I want to buy lower than the current ask price. |

Sell Limit | I want to sell higher than the current bid price. |

Buy Stop | I want to buy higher than the current ask price. |

Sell Stop | I want to sell lower than the current bid price. |

Buy Stop Limit | I want to buy lower than the price which I set. This price is always higher than the current ask price! |

Sell Stop Limit | I want to sell higher than the price which I set. This price is always lower than the current bid price! |

How long does a pending order take?

Pending orders can be set for a specific time. There are currently several options in MT:

GTC stands for Good-till-cancelled. This order will remain in effect until it is executed or canceled.

Today. This type of order will be active only on the current trading day.

Specified. This order type will remain active until the specific day and time.

Specified day. This order type will be active until a particular date.

Can you stop a pending order?

A pending order can be canceled or modified at any time before execution. To cancel a pending order, click on the cross in MT or right-click on the order and select Modify or Delete.

Conclusion

With pending orders, you can significantly increase your trading efficiency with the trading platform.