Fundamental Analysis

Current Interest Rate

- The Bank of Japan (BoJ) maintains its benchmark rate at 0.50%.

Rate Hike Expectations

- Reuters forecasts a 25-basis-point hike to 0.75% in Q3 2025, likely in July.

Key Factors

- Inflation: Core inflation remains challenging, increasing pressure on the BoJ to adjust monetary policy.

- Wages: BoJ Governor Kazuo Ueda remains optimistic about consumption, indicating that rate hikes will continue if inflation accelerates towards the 2% target.

- U.S. Trade Policy: Protectionist measures from President Donald Trump’s administration could negatively impact Japan’s economy, according to 90% of surveyed economists.

JPY Trend Based on Fundamentals

Bullish Scenario

- A rate hike by the BoJ could strengthen the yen as higher yields attract foreign investors.

Bearish Scenario

- U.S. trade policies and inflation outpacing wage growth could weaken the yen by negatively impacting Japan’s economy.

Fundamental Comparison: USDJPY, EURJPY, AUDJPY

USDJPY

- Diverging monetary policies between the BoJ and the Federal Reserve, combined with trade tensions, could drive volatility in this pair.

EURJPY

- The European Central Bank’s decisions and the Eurozone’s economic outlook will influence this pair, especially if the BoJ raises rates before the ECB.

AUDJPY

- This pair is sensitive to commodity prices and the Reserve Bank of Australia’s monetary policy. A rate hike in Japan could strengthen the yen against the Australian dollar.

Technical Analysis

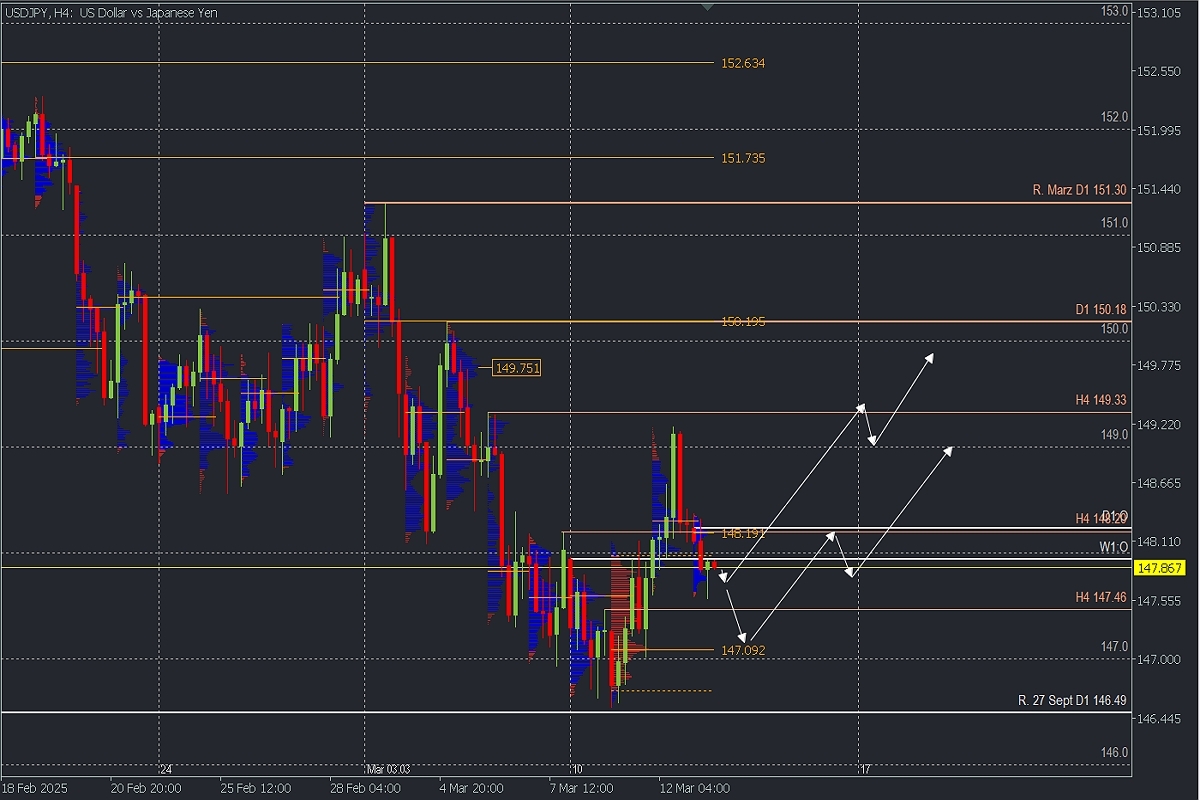

USDJPY, H4

- Supply Zones (Sell): 148.19 // 149.75 // 150.19

- Demand Zones (Buy): 147.09

- The pair is showing a bullish reversal structure after confirming a breakout above the 147.46 intraday resistance on H4. The last validated support now sits at 147.00, suggesting that as long as the current pullback remains above this level, the new trend remains intact.

- The daily open shows movement below a volume concentration at 148.19, correcting towards the broken resistance zone. Given the weakening pullback, a rebound from this area is expected, targeting a breakout above the Asian POC at 148.19, with 149.00 and 149.33 as short-term objectives, extending towards high-volume nodes at 149.75.

- A deeper correction could seek buy liquidity at the discovered POC at 147.09, while maintaining the bullish bias and resuming buys towards 148.00 and 149.00.

EURJPY, H4

- Supply Zones (Sell): 161.43 // 163.64 // 164.09 // 164.55

- Demand Zones (Buy): 160.00 // 159.55

- This pair has been in an uptrend since last week, with the last validated intraday support at 155.58. The 158.89 level did not retrace 50%, and buy orders have yet to reach 80% of the previous expansion, both key conditions for confirming levels objectively.

- The ongoing bearish correction has already reached and surpassed a buy zone at 160.68, suggesting a broader pullback towards 160.00 or even 159.68, where buy orders are expected to reactivate with targets at 163.00 and the supply zone between 163.64 and 164.55.

AUDJPY, H4

- Supply Zones (Sell): 93.68 // 94.98

- Demand Zones (Buy): 92.71 // 92.32

- This pair has broken the last intraday resistance on H4 at 93.48, followed by a 50% retracement towards 93.00, where a rebound is expected towards 94.00, with next resistance levels at 94.39 and 94.71, and a discovered POC from two weeks ago at 94.99.

- A deeper correction could extend to a high-volume buy node at 92.71 or the discovered POC at 92.32, where buy liquidity could be absorbed for a potential rebound towards 94.00 and 95.00.

- This bullish reversal scenario will be activated on M5 with institutional reversal patterns (PAR). The bullish outlook would be invalidated if sellers decisively break the last key support at 91.80.

Always wait for the formation and confirmation of a Reversal/Exhaustion Pattern (PAR) on M5 before entering trades at the key zones indicated.